Table of Content

HELOCs are better for people who are paying their child's college expenses each year and other types of staggered periodic expenses. On fixed-rate loans lenders typically charge a higher interest rate for longer duration loans. For example, a lender might charge 5.09% for a 10-year fixed rate loan, or 5.75% for a 15-year fixed rate loan. A new mortgage can also help you tap your home equity if you choose a cash-out option.

Rates may vary due to a change in the Prime Rate, a credit limit below $100,000, a loan-to-value above 70% and/or a credit score less than 730. A U.S. Bank personal checking account is required to receive the lowest rate, but is not required for loan approval. Customers in certain states are eligible to receive the preferred rate without having a U.S. The rate will never exceed 18% APR, or applicable state law, or below 3.25% APR.

year refi? 15-year refi? Cash-out? What is right for me?

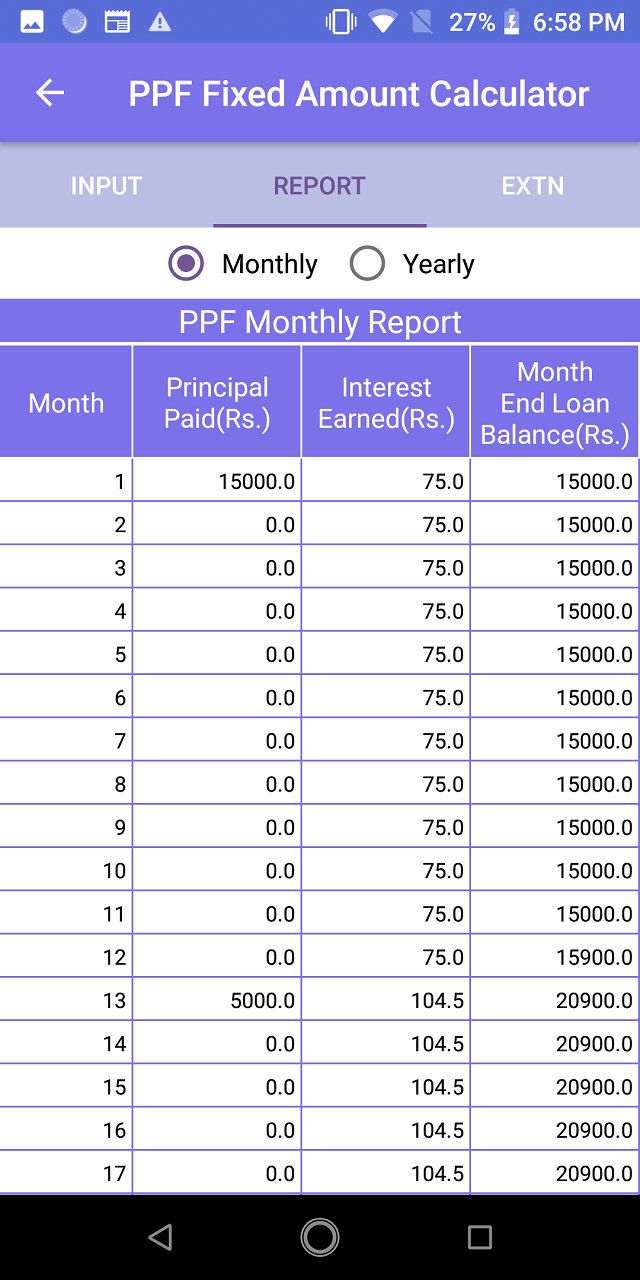

A home equity line of credit works more like a credit card, in that you're given a line of credit that you can continually borrow from and pay back over a set time frame. As the fixed-rate balance is paid down during the draw period, funds are replenished and available for use at the variable rate. Use this calculator to estimate monthly home equity payments based on the amount you want, rate options, and other factors.

This is the ratio between the value of your property and any outstanding loans on the property. It’s calculated by dividing the amount you still owe on your mortgage by the market value of your home. We use your address to find your estimated home value and estimated mortgage balance.

What's a Fixed-Rate Equity Loan?

When you apply, the lender will ask for personal information such as your name, date of birth and Social Security number. You’ll also be asked to submit documentation, which may include tax returns, pay stubs and proof of homeowners insurance. At account opening, the Fixed-Rate Loan Option is available for a maximum of 90% of your line of credit. The amount has been adjusted automatically to a lower initial withdrawal for more accurate payment results. Generally during periods with low interest rates most homeowners choose fixed-rate loans.

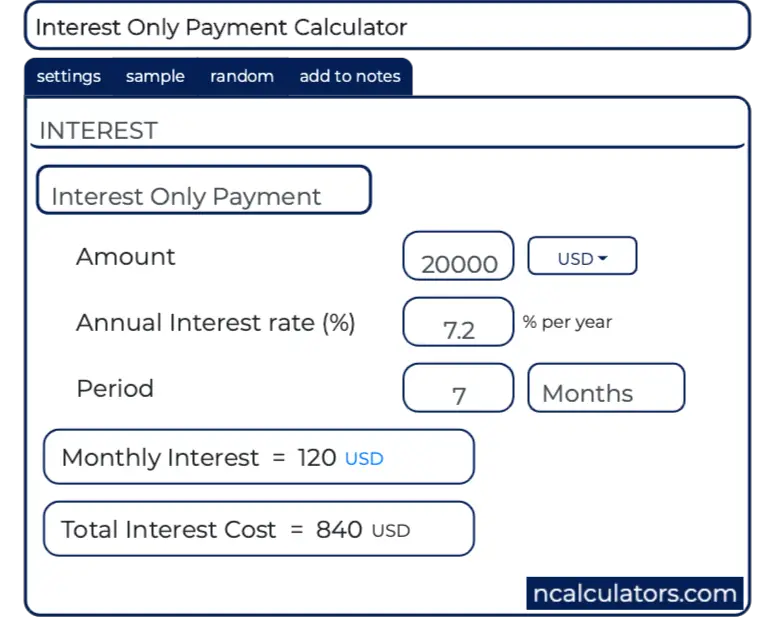

Choosing an interest-only repayment may cause your monthly payment to increase, possibly substantially, once your credit line transitions into the repayment period. Repayment options may vary based on credit qualifications. Loans are subject to credit approval and program guidelines. Not all loan programs are available in all states for all loan amounts. Interest rates and program terms are subject to change without notice.

Closing

When you have a HELOC you may be charged a small nominal annual fee - say $50 to $100 - to keep the line open, but you do not accrue interest until you draw on the line. Our rate table lists current home equity offers in your area, which you can use to find a local lender or compare against other loan options. From the select box you can choose between HELOCs and home equity loans of a 5, 10, 15, 20 or 30 year duration.

This would mean that if you borrowed $50,000 you might expect to pay $1,000 to $2,500 in closing costs. Because many homeowners locked in record-low rates in 2020 and 2021 and they've since since gone up, refinancing generally isn't a money-saving move at this time. Consider refinancing in the future if prevailing interest rates fall below the rate you currently have on your mortgage.

Find a lender who can offer competitive mortgage rates and help you with pre-approval

For loan amounts of up to $250,000, closing costs that members must pay typically range between $300 and $2,000. The closing costs depend on the location of the property, property type, and the amount of the Equity loan. Rates are subject to change—information provided does not constitute a loan commitment. In contrast, a HELOC is a revolving line of credit that taps your home equity up to a preset limit. HELOC payments aren’t fixed, and the interest rate is variable. You can draw as much as you need, up to the limit, during the draw period, which can last as long as 10 years.

While the calculator can give an estimate of how much you can borrow, talk to your lender to get accurate results based on a wider range of information. We’re transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money. Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate.

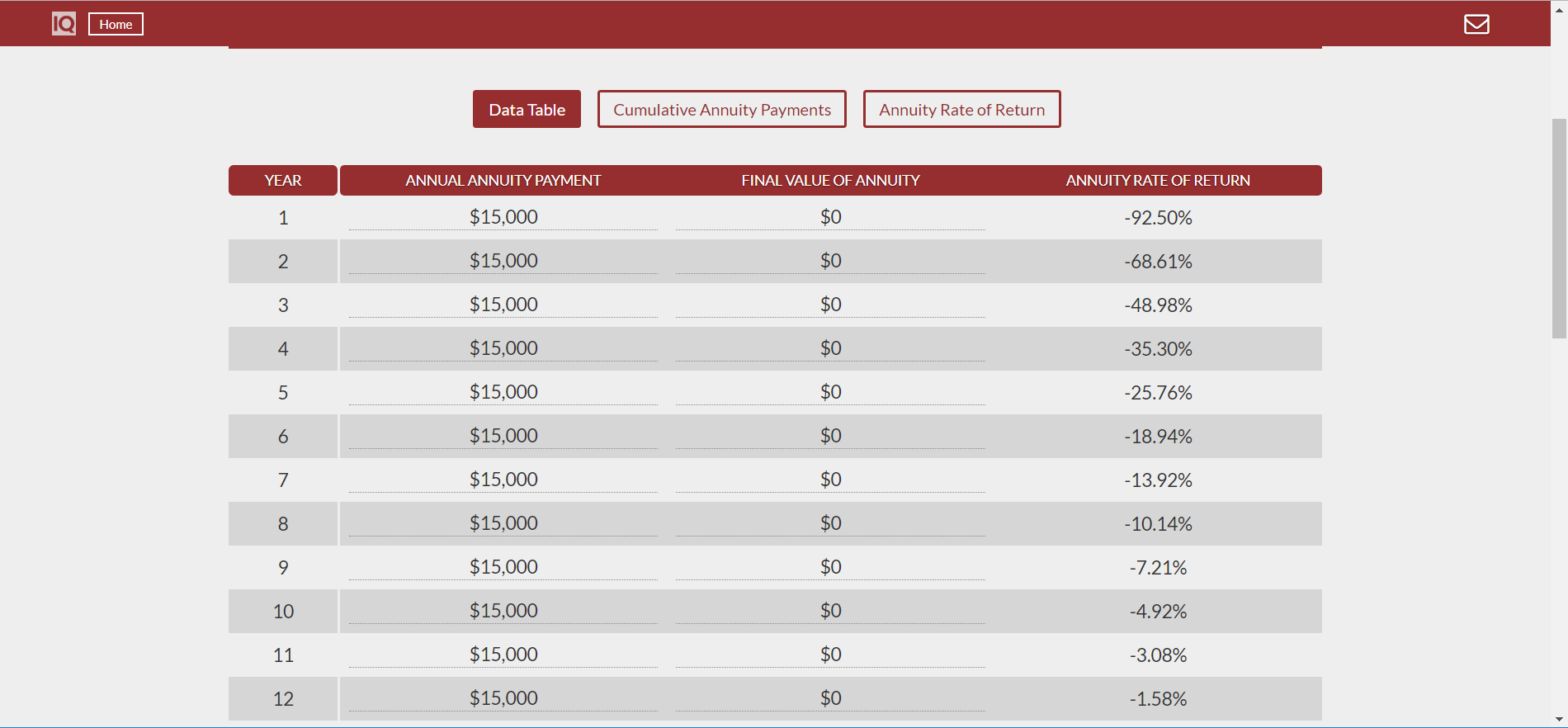

If you know you will pay your loan off quickly - before rates reset - then it may make sense to choose an adjustable rate option. Some lenders advertise loans with no closing costs, but they offset this lack of upfront fee by charging a higher interest rate on the loan. Home equity loans typically have a closing cost ranging between 2% and 5% of the amount borrowed.

The calculator will estimate your loan amount based on this information. If you don’t have enough equity in your home or your credit score is low, you may not qualify for a home equity loan. Our home refinance calculator shows how much you can save locking in lower rates. Home equity loans are typically available in fixed-rate formats whereas HELOCs typically charge adjustable rates.

For line amounts greater than $100,000, maximum combined loan-to-value ratios are lower and certain restrictions apply. For line amounts greater than $500,000, maximum combined loan-to-value ratios are lower and certain restrictions apply. Our maximum loan amounts and available equity requirements vary by property type. This link takes you to an external website or app, which may have different privacy and security policies than U.S.

Lenders generally won't allow you to borrow 100% of the value of your home. In certain market conditions, you may be able to borrow up to 90 or even 95% of the home's value but in today's market, 80 or 85% is common. Questions and responses on finder.com are not provided, paid for or otherwise endorsed by any bank or brand. These banks and brands are not responsible for ensuring that comments are answered or accurate. A steady income, more equity and low debt are key to getting approved with bad credit.

Closing costs

A fixed-rate advance gives you the flexibility to secure a fixed-interest rate on any or all of your outstanding line balances during the draw period so your payments remain the same each month. Before you apply, we encourage you to carefully consider whether consolidating your existing debt is the right choice for you. Consolidating multiple debts means you will have a single payment monthly, but it may not reduce or pay your debt off sooner. The payment reduction may come from a lower interest rate, a longer loan term, or a combination of both. By extending the loan term, you may pay more in interest over the life of the loan. By understanding how consolidating your debt benefits you, you will be in a better position to decide if it is the right option for you.