Table of Content

HELOCs act more like credit cards; you can borrow what you need as you need it, up to a certain limit. HELOCs have adjustable or variable interest rates, meaning your monthly payment can change, but you pay interest only on the amount you draw. A Smart Refinance loan is a no-closing-cost mortgage refinance option that lets you take advantage of lower rates, get cash out at closing and change your loan term to 5, 10, 15 or 20 years. The monthly payment reflects both the repayment for the cash out at closing and your monthly mortgage payment. The repayment timeline can range from five years to 30 years, depending on the terms of your loan.

A fixed-rate advance gives you the flexibility to secure a fixed-interest rate on any or all of your outstanding line balances during the draw period so your payments remain the same each month. Before you apply, we encourage you to carefully consider whether consolidating your existing debt is the right choice for you. Consolidating multiple debts means you will have a single payment monthly, but it may not reduce or pay your debt off sooner. The payment reduction may come from a lower interest rate, a longer loan term, or a combination of both. By extending the loan term, you may pay more in interest over the life of the loan. By understanding how consolidating your debt benefits you, you will be in a better position to decide if it is the right option for you.

Closing costs

A reverse mortgage is a type of loan that allows seniors to borrow against the value of their homes. The loan does not have to be repaid until the borrower moves, sells, or dies. Compare up-to-date mortgage rates and find one that's right for you.

If you locked in a mortgage rate of 3 percent, for instance, a new cash-out refinance now likely won’t make sense. Here we’ll take a look at two options and how they work. If you’re uncomfortable with your estimated monthly payment, look into trimming expenses in your budget or increasing your income to fill in the gaps. If the estimated monthly payment of your home equity loan or HELOC is higher than you’d like, use our tips to lower it. Debt consolidation and home improvements are the most common reasons homeowners borrow from their equity, says Greg McBride, CFA, chief financial analyst for Bankrate. There are other reasons borrowers might tap home equity, as well, such as education costs, vacations or other big-ticket purchases.

HELOC & Home Equity Loan Qualification

You can get an idea of your home’s equity easily using the above calculator. Simply input your address, home value and what you still owe on your mortgage. Then choose your credit score to see how much you might be able to borrow via a home equity loan. The amount you can borrow is based largely on your loan-to-value ratio, or LTV ratio.

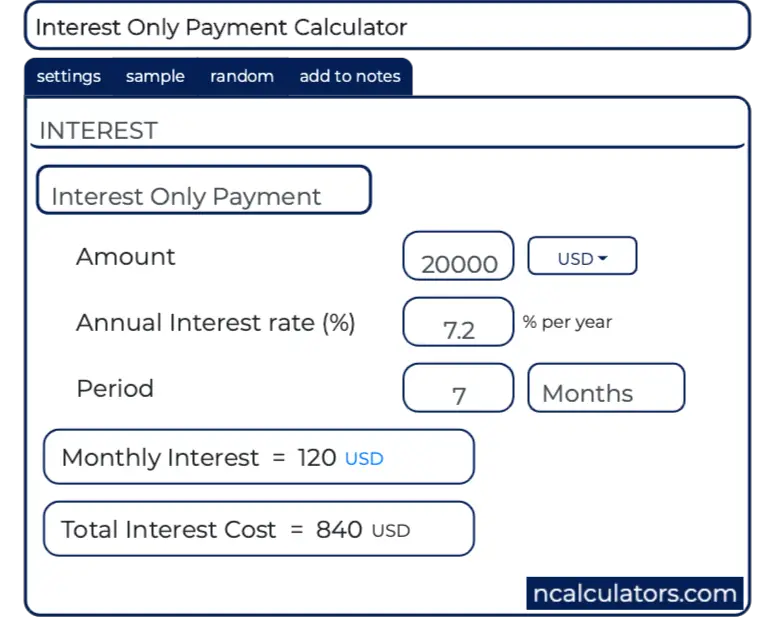

Choosing an interest-only repayment may cause your monthly payment to increase, possibly substantially, once your credit line transitions into the repayment period. Repayment options may vary based on credit qualifications. Loans are subject to credit approval and program guidelines. Not all loan programs are available in all states for all loan amounts. Interest rates and program terms are subject to change without notice.

You’re our first priority.Every time.

Your lender will extend credit, based on several factors including your credit history and the equity in your house. For example, if you’re extended $50,000 and use just $25,000, then you only owe $25,000. Home equity loans and HELOCs are two types of loans that use the value of your house as collateral. The main difference between them is that with home equity loans you get one lump sum of money whereas HELOCs are lines of credit that you can draw from as needed. HELOCsare variable-rate loans, which means your interest rate may adjust periodically. If you’re worried about rising rates, see how much a fixed-rate home equity loan could save you by keeping the rate change field at 0 percent.

You understand that you are not required to consent to receiving autodialed calls/texts as a condition of purchasing any Bank of America products or services. Any cellular/mobile telephone number you provide may incur charges from your mobile service provider. Payments on a home equity line of credit are based on the total amount you withdraw.

Homeowners who had up to $1 million in mortgage debt before the new tax law was passed will still retain the old limit even if they refinance their homes. If you are not consolidating old debts into your home equity loan, just enter zeros in the top row of the calculator then enter your equity loan information just above the calculate button. The average 30-year fixed-refinance rate is 6.67 percent, down 1 basis point from a week ago. A month ago, the average rate on a 30-year fixed refinance was higher, at 6.91 percent. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout life’s financial journey.

When you have a HELOC you may be charged a small nominal annual fee - say $50 to $100 - to keep the line open, but you do not accrue interest until you draw on the line. Our rate table lists current home equity offers in your area, which you can use to find a local lender or compare against other loan options. From the select box you can choose between HELOCs and home equity loans of a 5, 10, 15, 20 or 30 year duration.

Tap into your built-up home equity with a fixed-rate loan. Navy Federal does not provide, and is not responsible for, the product, service, overall website content, security, or privacy policies on any external third-party sites. The Navy Federal Credit Union privacy and security policies do not apply to the linked site. Please consult the site's policies for further information.

This would mean that if you borrowed $50,000 you might expect to pay $1,000 to $2,500 in closing costs. Because many homeowners locked in record-low rates in 2020 and 2021 and they've since since gone up, refinancing generally isn't a money-saving move at this time. Consider refinancing in the future if prevailing interest rates fall below the rate you currently have on your mortgage.

Bankrate.com does not include all companies or all available products. When borrowing large sums of money many borrowers choose cash out refi rather than a home equity loan. Monthly payments on a 10-year fixed-rate refi at 6.12 percent would cost $1,116.24 per month for every $100,000 you borrow. That hard-to-swallow monthly payment comes with the benefit of paying even less interest over the life of the loan than you would with a 15-year term.

No comments:

Post a Comment